How carbon trading works

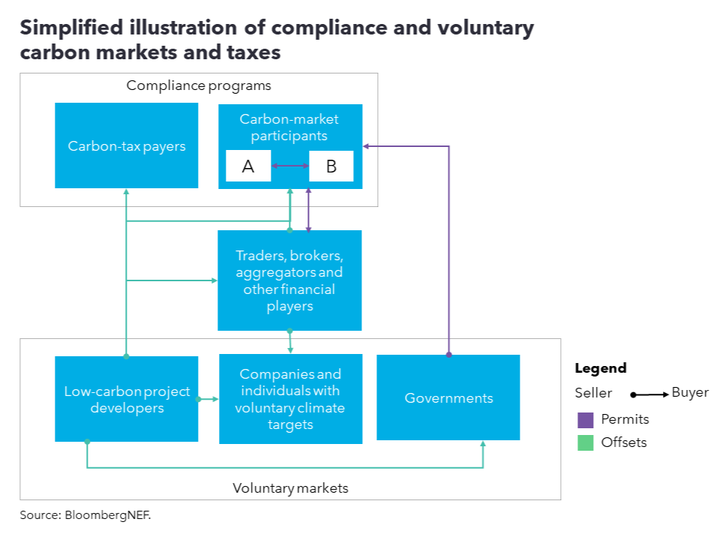

Carbon trading entails the buying and selling of certificates, of which the most common are permits and offsets. Permits, also known as allowances, represent the right to release one metric ton of greenhouse-gas emissions, and offsets, also known as credits, represent one metric ton of emissions reduced or avoided. The goal of carbon trading is to drive emission reductions for least cost.

Key message

Carbon permits may be bought and sold as part of a mandatory emissions-trading scheme, with most transactions occurring on an exchange. In contrast, carbon offsets may be traded by participants in some compliance programs as well as companies, governments and individuals with sustainability targets. Since credit prices vary significantly due to factors like additionality, brokers are still often used.

Compliance versus voluntary carbon markets

Participants trade permits in compliance carbon markets, like emissions-trading schemes or baseline-and-credit programs. Governments and regulators introduce and manage such programs, and determine which companies should be mandated to participate, as well as setting their compliance obligation. Failure to meet these rules generally results in a financial or other penalty. Some compliance markets allow participants to surrender offsets for meet their obligations. Offsets are also at the heart of the new carbon market mechanisms governed by Article 6 of the Paris climate agreement.

In addition, companies, governments and individuals buy and retire offsets to compensate for their greenhouse-gas emissions, in order to achieve their climate targets. These commitments are voluntary – hence these systems are known as the voluntary carbon markets.

As with other commodities, the price in a compliance carbon market is determined by the supply and demand of permits and other certificate types such as offsets that may be used by participants. Pricing may also be influenced by players’ views on future trends and behaviors. A cap-and-trade program aims to incentivize companies to cut their emissions if the cost of that reduction (or abatement) is lower than the carbon price.

Supply depends on the volume of permits issued by governments as free allocation or via other channels such as auctions. In addition, many emission-trading schemes allow participants to retain (bank) permits into the next compliance period and some also allow them to borrow permits from future periods. On the demand side, in general, the government reduces the emissions cap, to make companies reduce their greenhouse-gas output further. The pace and scale of these reductions will likely be shaped by the government’s overall climate commitments. All else being equal, this increases demand and potentially permit prices.

In the voluntary carbon markets, offsets are issued to projects that reduce, remove or avoid greenhouse-gas emissions. Demand comes from companies, organizations, governments and individuals that have voluntary set climate targets such as to reduce greenhouse-gas output by a certain volume. These players opt to buy and then retire offsets to compensate for or ‘offset’ their emissions. These markets operate outside compliance schemes and are policed by non-governmental organizations and a handful of registries like the Verified Carbon Standard and Climate Action Reserve.

Some compliance markets allow participants to meet their obligations by submitting offsets instead of purchased permits, often with some conditions. Some governments have set up offset schemes to promote low-carbon projects within their jurisdiction. They may be linked to a compliance carbon market or tax in the same country or region such as the programs in Canada and California.

Primary and secondary markets

This distribution of permits to participants in a compliance carbon program is known as the primary market. Secondary markets comprise all subsequent trading of permits and offsets. Trading can occur directly between buyers and sellers, or via an exchange or another intermediary. Like other commodity markets, permits can be traded through spot and derivatives contracts and in the case of the latter, through futures, options and other standardized contracts. In 2023, revenues from compliance carbon markets reached close to $1 trillion and this was largely due to high CO2 prices in the EU ETS and the California-Quebec market. Some movements in revenues from the German emissions trading scheme also contributed to this. In general, exchanges can provide more price transparency and reduce counterparty risk, while over-the-counter trades can give more flexibility for buyers and sellers.

Compliance units like permits tend to resemble more closely a commodity, meaning little or no variation between prices and quality. Therefore, transactions often occur via an exchange. In contrast, offset prices vary significantly based on hard-to-quantify factors like additionality, permanence, sector and location. As such, they are mainly traded via brokers. There are signs of the commoditization of carbon offsets as these units are increasingly traded on exchange, with the use of standardized products, for example. While these aim to reduce the complexity and promote the liquidity of the voluntary carbon markets, they may also reduce transparency. If buyers cannot be certain that the offsets included in these contracts are high quality, this may reduce the price they are willing to pay. The use of standards and ratings could mitigate some concerns.

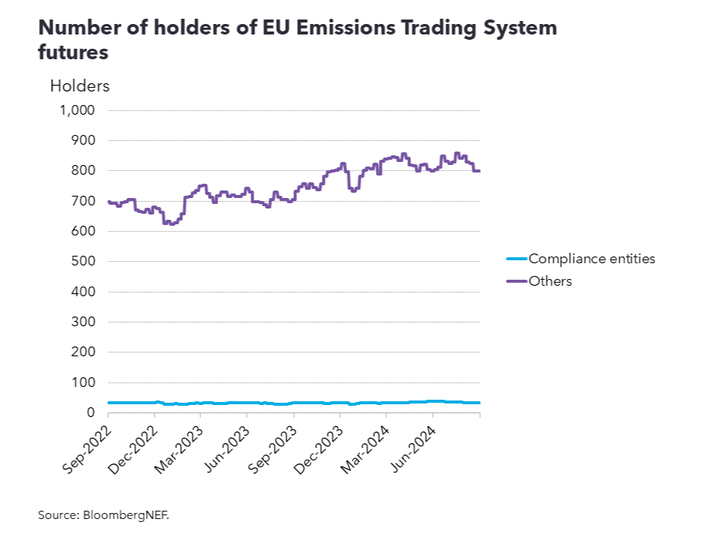

Historically most activity in compliance carbon markets has been shaped by obligated parties in such schemes. But in recent years, financial players have begun to play a bigger role at least in markets where they are allowed to participate. These companies can act as intermediaries and provide liquidity. In the EU Emissions Trading System, for example, rising prices have led to an influx of retail speculators.

Speculators can increase volatility and create price spikes if used opportunistically. But financial intermediaries may provide price support, as they have been attracted to carbon due to strong returns. Carbon markets give investors access to a tool that tracks the energy transition with a diversified approach. Meanwhile, it allows investors to hedge their carbon exposure elsewhere in their portfolio. The risk profile is also limited as carbon is fundamentally a climate tool for regulators.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.