Offsets in compliance carbon programs

intermediate

|

18 Oct 2024

Offsets in compliance carbon programs

Some of the biggest compliance carbon markets and taxes around the world allow participants to submit offsets in order to meet their obligations. The aim is that emissions reduction occurs where it is cheapest to do so, while low-carbon projects can bring revenue and other benefits to local communities. In addition, offsetting can help companies in hard-to-decarbonize sectors compensate for their emissions without having to change their business models or risk investing in non-viable technologies.

Key message

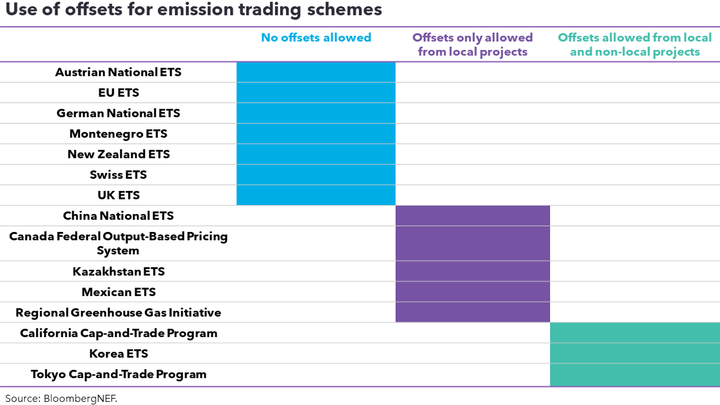

Some compliance markets allow participants to use carbon offsets to meet their emission obligations. However, many governments have imposed restrictions on

these credits – for example, on the location or sector of the low-carbon project – and some have banned them entirely.

Drivers

A number of compliance markets and taxes allow participants to submit carbon offsets to meet their emissions obligation. The units are generated by low-carbon projects and typically verified via one of three mechanisms:

-

National or regional carbon offset schemes linked to compliance programs, such as California’s offset scheme or Australia’s Emissions Reduction Fund

-

International crediting mechanisms, such as the Clean Development Mechanism (CDM)

-

Voluntary carbon registries, such as Verified Carbon Standard or Gold Standard.

Crediting mechanisms can broaden the price signal and generate low-carbon incentives in sectors not subject to compliance obligations due to technical, political or other reasons. This can spur low-carbon investment in such sectors and improves the economic efficiency of an emissions-trading scheme. These advantages, as well as lower compliance costs, could make it easier for policy makers to expand the scope of a mandatory program.

Restrictions

In some cases, policymakers want to allow companies to use offsets as part of a domestic carbon tax or market. However, rather than relying on the voluntary market, governments may also want to impose specific restrictions such as on project type or simply to promote offset integrity and credibility. For example, participants in Australia’s baseline-and-credit program and Kazakhstan’s emissions trading scheme may only use offsets from local projects, but face no volume constraints

By contrast, several programs allow a limited proportion of compliance obligations to be met with carbon offsets – some 5% in South Korea’s emissions trading system in Phase 3 of the program (2021-2025). South Korea is one of the rare programs that allows credits generated from projects outside the jurisdiction.

It is also common for offset use to be subject to restrictions on the type of project and “vintage” – in other words, age. For example, emitters in Chongqing’s pilot emissions trading program may not use offsets generated from hydropower projects.

The uptake of compliance offsets could also change the dynamics in global offset markets. Since compliance schemes typically have strict criteria for eligible carbon offsets, more expensive and higher quality projects – such as robust nature-based solutions and emission-removal credits – could be drawn to compliance markets, leaving the voluntary offset market with lower-quality, lower-cost credits.

Compliance markets that do not accept offsets

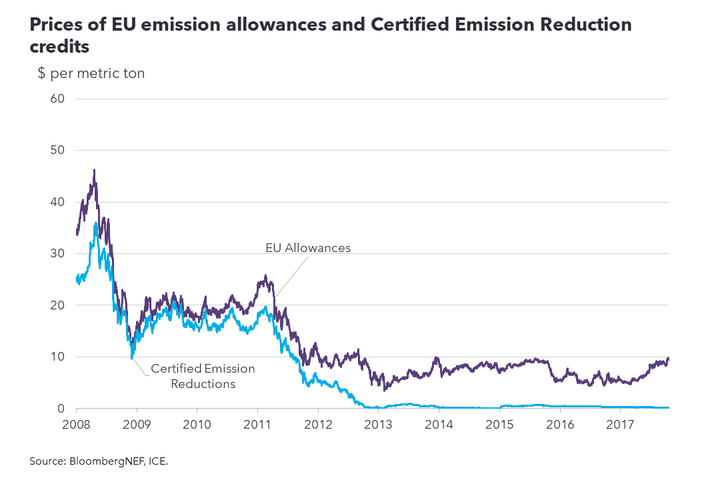

The rationale for restrictions on offset use is similar to the reasons why such credits are banned by several major compliance markets, such as the UK, European Union and New Zealand emissions trading schemes. Wariness regarding the acceptance of offsets in these programs stems from their checkered history. Until 2020, participants in the EU Emissions Trading System were allowed to submit international offsets generated under the Kyoto Protocol’s CDM and Joint Implementation (JI) for compliance. But the problems associated with their environmental integrity not only destroyed their credibility, but also led to a glut of credits, exacerbating the oversupply in the EU ETS. Certified Emission Reduction (CER) credits issued by the CDM fell from over $23 per metric ton in 2008 to just $0.01 per metric ton in 2014.

Questions around the environmental robustness of some offset projects have led to concerns about additionality, and challenges around how to quantify emission reductions. Offsetting could also delay investment in cost-effective, low-carbon solutions for hard-to-abate sectors. Furthermore, there is uncertainty around the ability of some carbon offsets to guarantee a permanent emissions reduction, while there are no such questions surrounding direct emission reductions.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.