Voluntary offset standards

Voluntary carbon offsets prices vary significantly, even for projects in the same sector and location (see the factsheet on offset quality). While pricing is a black box for now, emerging standards from independent organizations such as the Integrity Council for the Voluntary Carbon Market (ICVCM) are creating frameworks to assess the quality of a project, and prices should follow soon. Until offset standards and regulations are set in stone, buyers have to work with a third party, which can further complicate and lengthen the purchasing process.

Initially, critics were concerned about too many cooks being in the voluntary carbon kitchen. Having too many initiatives trying to standardize the same market could result in further fragmentation. However, initiatives like the ICVCM and Voluntary Carbon Market Integrity Initiative (VCMI) as well as registries, presented a united front at COP28 in Dubai, announcing collaborations between one another. Moving forward, the market’s definitions of high-quality offsets are converging, paving the way for a centralized market infrastructure

Key message

A raft of initiatives are underway to improve the environmental rigor of voluntary carbon markets, such as the ICVCM and the VCMI. Additionally, the Science Based Targets initiative can affect carbon offset demand, as it dictates eligible emission reduction techniques for its registered companies. Alongside these initiatives, there is substantial work being done by private-sector players, who are developing technologies to improve monitoring, reporting and verification processes.

Science Based Targets initiative

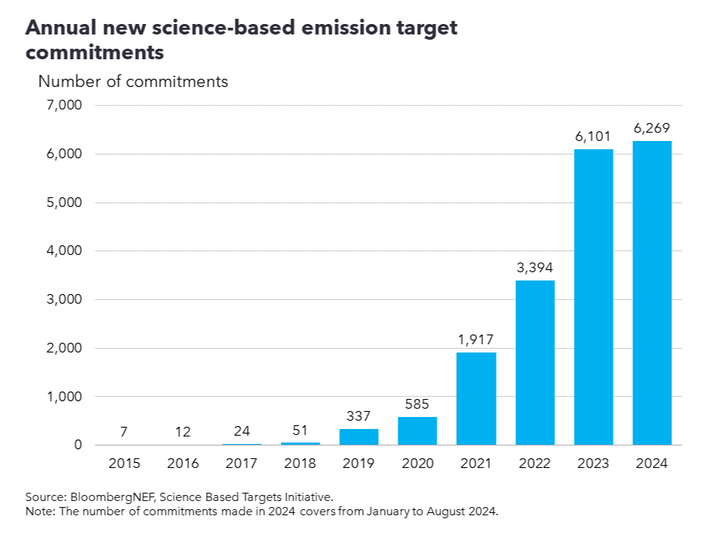

The Science Based Targets initiative (SBTi) is the largest third-party initiative verifying companies’ emissions-reduction commitments. To date, almost 9,000 companies have set, or agreed to set, a science-based emissions target, meaning they pledge to cut their greenhouse-gas output in line with the aims of the Paris Agreement. Their goals must meet a range of criteria that aim to ensure credibility – for example, the targets must cover at least 95% of company-wide Scope 1 and 2 emissions – and carbon offsets may not be used.

However, the SBTi published its net-zero framework in 2021, allowing companies to take their science-based targets a step further and pledge to fully reduce and/or offset their emissions by 2050. In order to do this, firms should be reducing their gross emissions by 50% by 2030 and at least 90% by 2050. The SBTi determines this to be a Paris-aligned trajectory, with slight variations depending on sector. Contrasting the regular science-based targets, companies could use offsets for their net-zero targets for any remaining, or ‘residual’, emissions. However, in April 2024, the SBTi announced that it would allow wider use of offsets to cover Scope 3 emissions, which come primarily from suppliers upstream, the use of products by customers downstream, and corporate travel. These emissions make up the largest share of a typical company’s carbon footprint and are the hardest to measure and reduce.

At the time of the announcement, the SBTi said that it would devise the precise rules around the use of offsets for tackling Scope 3 emissions. Should the limitations on the use of offsets remain strict, companies may be forced to invest more in reducing their own gross emissions, eliminating the need to offset as much as they can. Otherwise, they risk being dropped from the standard.

Integrity Council for the Voluntary Carbon Market

Standardization bodies and integrity initiatives aim to create a homogenous definition of high- and low-quality offsets, the lack of which is weighing on buyer confidence and hindering the market from scaling up. In the absence of centralized definitions and standards, organizations are following a divide-and-conquer method.

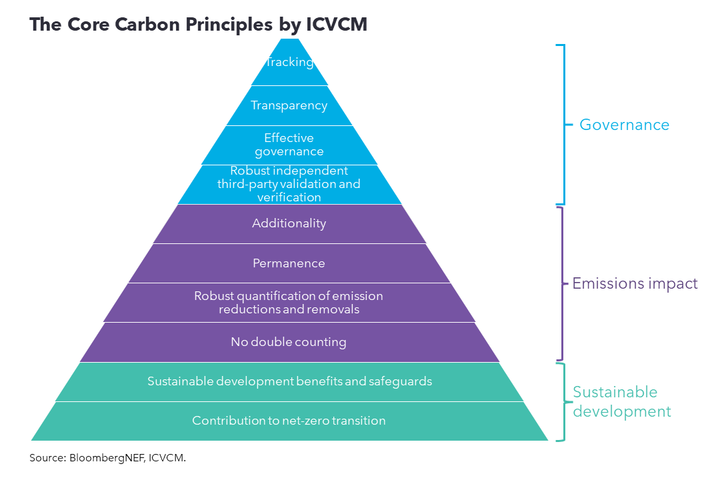

For example, the ICVCM was created to focus on tackling quality and integrity concerns on the supply side of the market. The ICVCM’s two key deliverables are the Core Carbon Principles (CCPs), which are the pillars for what a good offset should include, and Assessment Frameworks (AFs) to help evaluate individual credits and projects. The CCPs and AFs outline several characteristics for a registry-approved carbon credit to be compliant with the standard, in addition to further attributes (credit tags). Similar to other market participants, CCPs emphasize the need for additionality, measurability, no double-counting, permanence, governance and co-benefits.

Additionally, the CCPs require transparent and rigorous information of mitigation activity of an offset project, as well as robust independent third-party verification, and a clear positive transition to net zero. As for the attributes, they are meant to provide further information about a carbon credit beyond its quality. For instance, the type of mitigation activity – whether a credit type was avoidance or removal – is an attribute.

The ICVCM was launched by the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), which was created by the International Institute of Finance in partnership with a committee of public and private taskforce members. The group aimed to serve as a steward for the carbon offset market.

Voluntary Carbon Market Initiative

The VCMI is an independent governing initiative that aims to improve standards on the demand side of the market, rather than supply like ICVCM. The VCMI helps organizations determine the circumstances under which they can make credible use of voluntary carbon, as well as what claims (standards) they can use.

This is defined through the VCMI Claims Code of Practice, which outlines prerequisites and steps for organizations to be able to use offsets under three tiers: VCMI Bronze, Silver and Gold. These claims can be met either on an enterprise or a product level. Before purchasing carbon credits to offset emissions, companies must pledge to achieve science-aligned decarbonization targets for the entire value chain (Scope 1, 2 and 3 emissions).

The VCMI Gold Claim means that a company is on track to achieving Scope 1, 2 and 3 emissions interim targets, and 100% of its residual emissions are neutralized by high-quality carbon credits. On the other hand, a VCMI Bronze Claim means that a company is partially on track to achieve Scope 3 emissions interim targets, but only 20% (at least) of its residual emissions are covered by high-quality offsets. Such progress and claim eligibility are monitored consistently by a credible third party. VCMI does not net set quality guidelines for credits, yet it acknowledges the definitions set by ICVCM, Corsia and SBTi.

Technology-based initiatives

Beyond initiatives focused on market design, dozens of companies are raising money for technologies aimed at improving the reputation of the offset market. Many, including Pachama, Cloverly and Cooler.dev, are focused on enhancing measurability, creating their own unique technology cocktails of lidar, satellite imagery, drones and atmospheric data to better estimate and measure offset supply, specifically from forestry and agriculture projects. Such technologies aim to improve the monitoring, reporting and verification processes of carbon projects.

Some of these firms are more focused on verification and bifurcation of quality. Beyond helping to measure emission reductions, Pachama, for example, is building its own marketplace for projects that have been verified with its technology, reassuring customers that they are investing in high-quality projects. There are also rating agencies like BeZero and Sylvera that provide scores for carbon projects, based on several risk factor assessments to help buyers build a low-risk offset portfolios.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.