Current state of carbon trading

Global carbon markets have grown exponentially in the last few years. Governments’ increasingly ambitious climate targets have led to new compliance emission trading schemes and higher prices in existing carbon markets. The voluntary markets have also seen a surge in demand on the back of bold corporate sustainability pledges. But supply has failed to keep up, leaving the markets overflowing with cheap, low-quality offsets because of poor oversight.

Key message

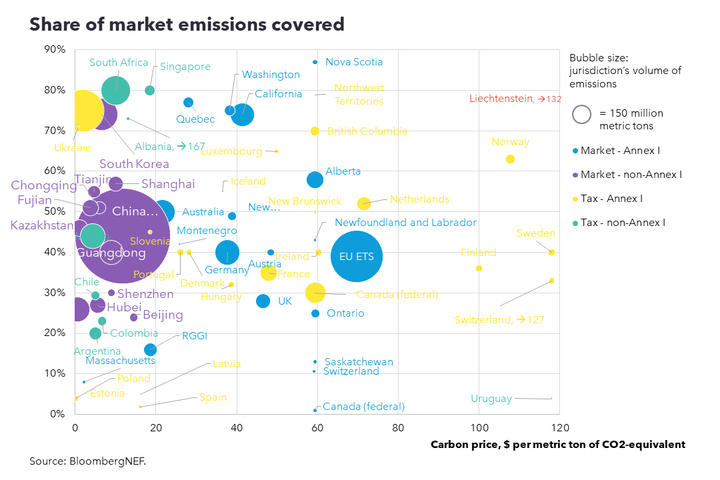

Governments have implemented about 33 compliance carbon markets around the world, with 14 others under development and eight under consideration. But few have prices high enough to drive decarbonization. Meanwhile, companies’ increasingly ambitious climate targets mean demand for carbon offsets has never been higher. But the voluntary carbon markets remain oversupplied.

Compliance markets

A growing number of countries with decarbonization ambitions have introduced compliance carbon markets as a more politically palatable option than carbon taxes. More than 30 such programs are in force, covering about 18% of global greenhouse-gas emissions. In 2023, compliance carbon markets generated a revenue of close to $1 trillion.

These compliance markets are growing rapidly in terms of traded value as a result of the rising price per unit of emissions traded. The growth can be attributed to the emission trading schemes implemented by various countries and regions globally. According to LSEG, the value of the EU ETS, which currently makes up about 87% of the global carbon market, increased by about 2% from 2022. Its total worth is about €770 billion as of 2023. ETS will continue to play a vital role in creating economic incentives for reductions in emissions and driving the transition to a low-carbon economy.

However, most of global emissions are not covered by a carbon price at or above the estimated range required to limit global warming to 2 degrees C above pre-industrial levels by the end of the century. This range of prices was estimated to be $63-127 per ton of CO2-equivalent by 2030, as recommended by the World Bank's High-Level Commission on Carbon Prices. However, less than 1% of global GHG emissions are covered by carbon pricing instruments that are within this range. About two-thirds of the emissions are covered under ETS that have an average price of $10 in 2023.

Compliance carbon markets tend to focus on certain sectors, with power generation and industry being the most common. These typically comprise a limited number of emission-intensive companies, thereby reducing the administrative burden for regulators. However, as the power sector is decarbonized through renewables, governments are increasingly looking to expand compliance carbon markets to other sectors – such as transport, buildings, or agriculture – which have many point sources but make up an increasing share of emissions.

Moreover, seven major compliance carbon markets around the world now allow the use of offsets in some form, such as stipulations for locally generated carbon offsets, and a limit for the proportion of offsets allowed to be used toward compliance obligations. Compliance markets such as the EU ETS and New Zealand used to permit companies to use offsets generated under the Kyoto Protocol’s Clean Development Mechanism (CDM) and Joint Implementation for compliance, but stopped doing so after the vast availability of offsets contributed to an oversupply in the market, causing prices to crash.

Voluntary markets

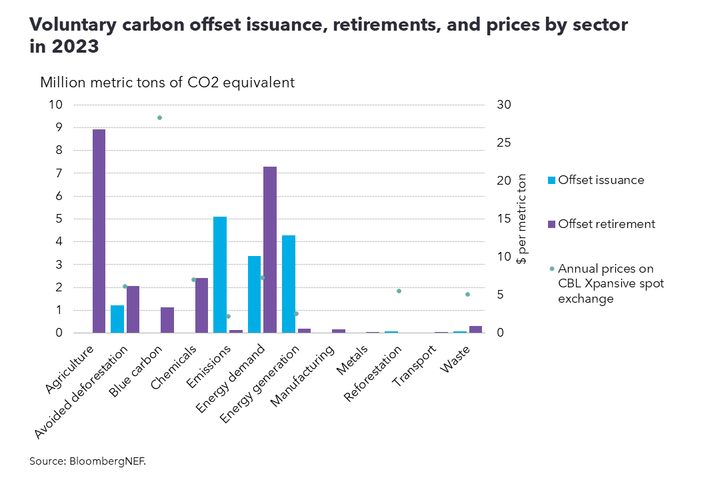

Alongside governments’ climate goals, corporate net-zero targets have created soaring demand for offsets in voluntary carbon markets. In 2023, companies retired 164 million credits, surpassing the previous record set in 2021 by about 2%. But supply still outstrips demand, and this will likely continue to 2050, unless carbon offset supply becomes regulated.

The price of voluntary carbon offsets varies by country and sector. Through August 2024, the average spot price of offsets across different sectors traded via CBL Xpansiv market exhange averaged at $8 per metric ton. There are several drivers affecting traded price of offsets, including risk associated with the carbon project and additional benefits beyond decarbonization.

A common factor is additionality – whether decarbonization would not have happened without offset revenue. Offsets from energy generation projects are the cheapest as they typically have low additionality. For example, renewable build in most of the world (except in some emerging markets) is economically feasible without additional support. Offsets from projects that actively absorbs emissions from atmosphere, or carbon removal projects, are among the most expensive as they rank highly on the additionality spectrum. A project’s location and credits' age, or vintage, also impact offset prices.

The most common offset sectors include energy generation, avoided deforestation, and projects that capture fugitive emissions. In 2023, energy generation made up 41% of offsets retired on various registries, including Verra, Gold Standard, Climate Action Reserve, and American Carbon Registry.

Asia Pacific, Latin America, and Africa continue to be the main regions issuing carbon credits, making up about 79% of total carbon offsets issued in 2023.

Currently, the voluntary market is moving toward becoming a commodity market. This is a much-needed step to support the large future demand for carbon offsets as governments and companies use them to achieve their net-zero goals. In particular, the market will need to move away from the current system of over-the-counter transactions between projects and buyers, to infrastructure that supports instantaneous and high-volume trade. The value chain will therefore be entirely different, focused more on exchanges, marketplaces, derivative products and universal definitions around quality.

Thus, for offsets to play a credible role in companies’ and governments’ climate strategies, current efforts to build trust in offsets need to come to fruition. Regulators and integrity initiatives need to agree on common definitions and standards on quality. In addition, financial regulators need to ensure the necessary checks and balances are implemented. This should enable the introduction of standardized contracts and future products.

Article 6 of the Paris Agreement established various tools to enable countries and companies to achieve their climate goals via collaboration on global carbon trading – namely Article 6.2, which allows parties to cooperate using internationally transferred mitigation outcomes (ITMOs), and Article 6.4, which established a global offset market similar to the Clean Development Mechanism. While Article 6 could help scale up and standardize offset markets, its exact implementation is still being determined and could take months or years.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.