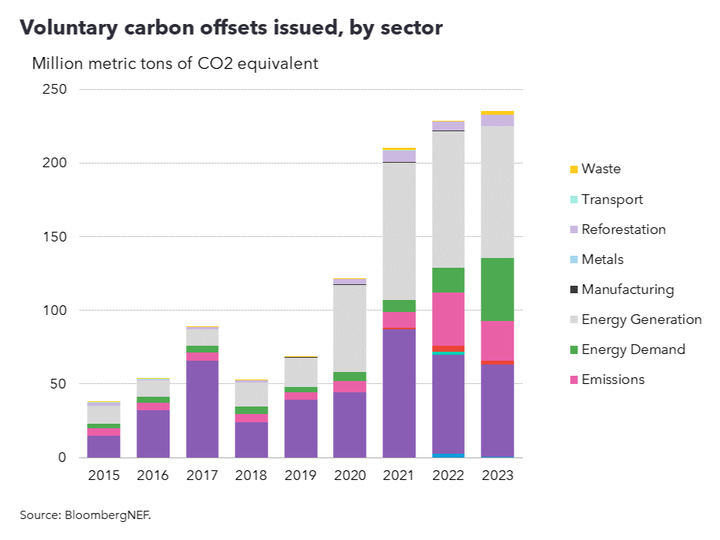

Environmental, social and governance considerations are becoming increasingly important to investors, spurring companies to ratchet up their sustainability commitments and look to carbon offsets to compensate for their emissions. Despite this growth, the voluntary carbon offset market remains oversupplied, with players having access to thousands of potential projects. In 2023, about 239.7 million offsets had been issued (1 offset represents 1 metric ton of carbon dioxide equivalent), which is more than four times the amount of offsets issued in 2018. However, issuing projects remain a modest, albeit increasing, share of the total registered.

Key message

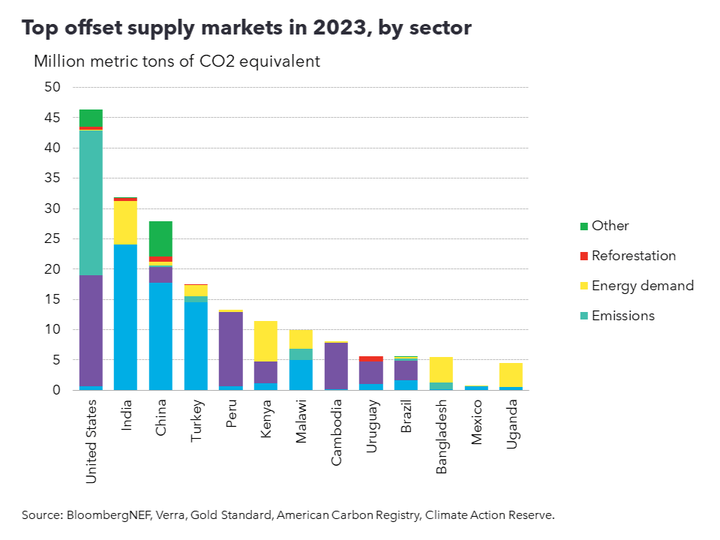

The voluntary carbon markets are oversupplied, with offset issuance increasing by more than three-folds from 2018 to 2023. Most have come from nature-based solutions, such as the planting of forests, or energy generation projects, like wind and solar farms. In terms of geography, the US initially accounted for the biggest chunk of credit supply but India, China, and Brazil now account for a growing share. These trends are set to change due to the introduction of integrity standards favoring certain offset supply sectors over others.

Sector

The annual issuance of offsets is accelerating. A new record for annual offset issuance was set in 2021. Although offset issuance has slightly dipped in 2022 and 2023, it remains high. Part of this momentum is being driven by new projects, but a significant amount of the growth is also coming from existing projects ramping up issuance to meet newfound customer demand. As of 2023, 4,711 projects are active on the four major registries (Verra, Gold Standard, American Carbon Registry, and Climate Action Reserve).

Carbon offsets can be produced by a number of sectors, each with their own strengths and drawbacks. The vast majority of supply has come from energy generation and avoided deforestation . Energy generation offsets are principally from renewables projects, but their role in the voluntary carbon market is set to diminish significantly in the longer term. A key reason is that wind and solar are cost-competitive with new coal and gas-fired power in most parts of the world, without subsidies. This renders energy generation offsets non-additional, as the emission reduction could have occurred without the sale of credits.

In addition, many of these projects already have support mechanisms in place, such as renewable energy certificates in the US and guarantees of origin in Europe, meaning they cannot produce offsets without double counting. Additionality is, therefore, hard to prove and, as a result, some registries will now only allow offsets to be generated from clean energy projects in least developed countries.

Nature-based solutions account for a similar share of total offset supply and typically entail reforestation and avoided deforestation projects. The conservation and management of forests around the world is of growing importance. As populations grow, the need for farming, cattle ranching, logging and space for living is magnified, putting forests at further risk of being cut down for these activities. This is concerning from a climate standpoint, as forests are one of the planet’s most effective natural carbon sinks, using photosynthesis to transform carbon into biomass, such as soil. When cut down, forests release the carbon they were sequestering and lose their ability to further store carbon. Offsets can be an effective tool to help finance the protection and management of forests, in Reducing Emissions from Deforestation and forest Degradation (REDD+) or Improved Forest Management (IFM) projects.

The planting of new trees, either in areas where forest used to exist (reforestation) or in completely new areas (afforestation), is the other key nature-based solution that will help spur the carbon offset market. Broadly classified as reforestation for simplicity in this article, new forests can offer all of the same benefits that REDD+ projects bring, such as the preservation of biodiversity and mitigation of climate risk. However, what separates reforestation projects from REDD+ is that they lead to new, additional carbon sequestration, hence they are considered 'carbon removal’ activities.

Emissions is the third-largest sector of offset supply, ones that avoid fugitive emissions or destroy greenhouse gases in industrial processes. Revenue from offsets created via emissions projects is typically used to fund the implementation of capture technologies at fossil-fuel extraction sites, manufacturing facilities or landfills.

In fourth place are energy demand projects. While this can mean energy efficiency upgrades in buildings, energy demand mostly pertains to installing clean cookstoves. In Africa and Asia, only 17% and 60% of the population have access to clean cooking, respectively. Instead, people rely on carbon-intensive fuels like dung, kerosene, coal, or wood to cook. Not only do these fuels lead to significant carbon emissions, but they can also stunt productivity in developing markets. Switching to cleaner cookstoves is an effective way to boost economic productivity in these markets while also decarbonizing. As a result, monetizing carbon offsets can be an effective tool to finance this transition.

Geography

Beyond sectors, companies can purchase carbon offsets created in any geography. Projects are registered to issue carbon offsets in over 120 markets around the world. Offset issuance in the US constituted more than half of the global annual offset issuance from 2015 to 2018. In 2023, the US was the top issuing market in the global offset market. However, the US’s share of global supply shrunk to 19% in 2023, down 62% in 2015. India and China are now the top issuing markets, accounting for 13% and 12% of global annual offset issuance in 2023, respectively.

The biggest markets issuing energy generation offsets are India, China and Turkey, although none of these nations are classified as a least developed countries. Activity is heavily concentrated in Asia, where legacy projects created for compliance carbon markets have earmarked some of their offsets for voluntary markets. Many of these offsets come from large hydropower projects and coal-to-gas switching. By contrast, the Americas and Central Africa account for the largest share of offset supply from nature-based solutions, due to the prevalence of rainforests.

The US leads the way in issuing ‘emissions’ offsets. Many emissions projects are focused on landfill-gas concerns or methane recovery from coal mines. North America is a world leader in carbon capture and storage, largely due to the presence of natural-gas processing plants, which have cheap carbon capture and tend to be located close to demand sites. Other drivers have been the availability of geological storage, backing and expertise from the mature oil and gas sector, and government support. In the future, more offsets are expected to come from direct air capture, which uses mechanisms like fans and pumps to draw in air and pass it through chemical solutions or solid filters to remove CO2. This CO2 can then be recovered from the collection system and stored.

Supply of energy demand offsets is led by Uganda, Bangladesh and Rwanda. Asia and Sub-Saharan Africa account for the vast majority of the global population without access to clean cooking. Carbon offsets are used as a mechanism to finance the distribution of clean cookstoves and plays a significant role in carbon offset supply that is additional and has co-benefits beyond decarbonization.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.