Things to watch in global carbon markets in 2025

intermediate

|

18 Feb 2025

Stepping into 2025, the year will mark significant acceleration in the growing interconnectedness of global carbon markets. BloombergNEF identified a few key developments that it anticipates will play out in 2025 in this acceleration process.

Key message

As global carbon markets become more interlinked, both compliance systems and voluntary carbon trading are set to expand their reach and make more headway. A few key developments stand out among the numberous changes that carbon markets will undergo in 2025.

Brazil to play an integral role in international carbon trading in 2025

Brazil is set to host the 30th edition of United Nations climate conference this November and is likely to put carbon trading at the forefront of the agenda. The UN Supervisory Body has been tasked with addressing the remaining roadblocks to facilitate the launch of the Paris Agreement Crediting Mechanism – known as Article 6.4 – which if successful could occur during the summit.

Beyond facilitating these talks, Brazil is also poised to be a key supplier of international carbon credits. It has a large potential for nature-based abatement, where credits are generated in projects where carbon emissions are avoided or removed.

BloombergNEF expects SBTi to allow more carbon credits

The Science Based Targets initiative (SBTi), the UN-backed standards body that serves as an arbiter for sustainability goals, is set to formalize rules relating to carbon credit use to achieve net-zero goals.

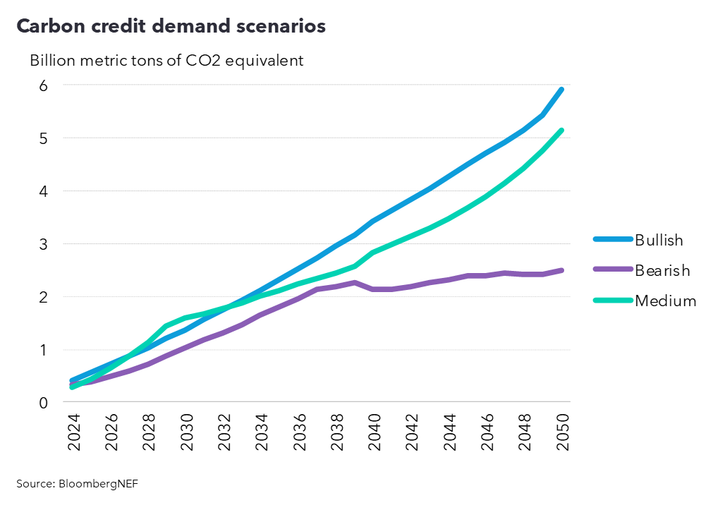

BloombergNEF expects it to allow carbon credits to be used for more than the existing threshold, set at 10% of residual emissions. Such a scenario could align the market more closely with BNEF’s bullish long-term demand projection, which reaches nearly 6 billion metric tons of carbon dioxide equivalent in 2050.

EU's Carbon Border Adjustment Mechanism (CBAM) to spur action in emerging markets

Many emerging markets are introducing domestic carbon pricing schemes, with timelines and scope that aligned with that of the European Union’s carbon border tariff.

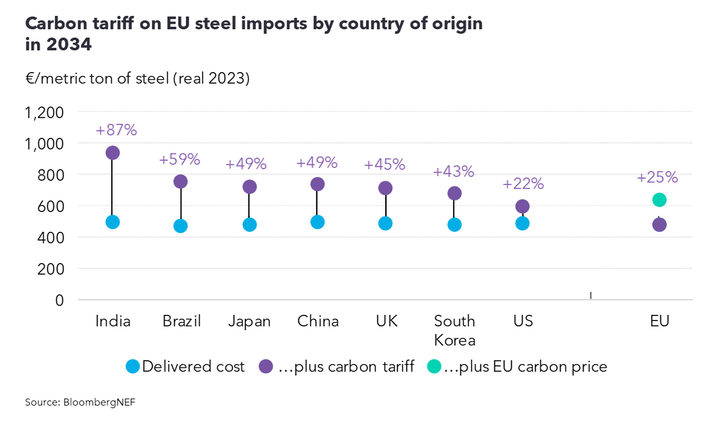

However, most markets will struggle to raise carbon prices to match Europe, resulting in their exports still being exposed to the tariff, at least in the first year of the EU CBAM implementation.

Major regulated carbon markets headed for a bullish 2025

China’s carbon price is likely to rise this year as new sectors are introduced into its emission trading system and allowance supply is reduced. But this is not the only regulated market that is headed for a bull run.

Newly reformed baselines in Australia’s Safeguard Mechanism could push prices above A$50 ($31) per metric ton in 2025, the highest since January 2022.

Meanwhile, prices in the linked California-Quebec carbon market are set to hit a record of over $40 a metric ton on average this year. This could be attributed to a greater demand but tightening supply of allowances.

The EU prepares for a second compliance carbon market for road transport and buildings

A new carbon market for road transport and buildings in the EU, dubbed ETS2, is set to submit its emissions report in 2025 in preparation for the market launch in 2027.

The Intercontinental Exchange’s (ICE) Endex Energy exchange announced plans to launch a futures product for ETS2 in May 2025. This will allow market participants to begin hedging, with participants pre-purchasing allowances to cover future demand and reduce risk.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.