Faced with more ambitious climate targets, governments and companies are searching for ways to achieve the emission reduction goals they have pledged. Article 6 of the Paris Agreement provides more opportunities to do so through collaboration between different countries and the private sector. Of the nine paragraphs outlined in Article 6, two have garnered immense attention from stakeholders for their relevance to global carbon trading: 6.2 and 6.4.

Article 6.4, known as the Paris Agreement Crediting Mechanism, established a framework for a centralized global carbon market where countries and companies can trade emission credits under the supervision of a UN supervisory body.

Key message

Under Article 6.4, a global mechanism for governments and companies to trade carbon credits would be created, supporting market players in achieving their climate goals and directing climate financing toward low-carbon projects. A Supervisory Body has been tasked with developing the requirements and processes needed to operationalize this mechanism.

In October 2024, the Article 4.6 Supervisory Body published a set of standards for methodologies and carbon removal activities to be approved under Article 6.4. However, a plethora of issues remain unaddressed, including verification processes, the operational mechanism, and corresponding adjustments. Depending on how the Article 6.4 mechanism is set up, there could be a convergence of the existing voluntary carbon market and Article 6.4.

How it works

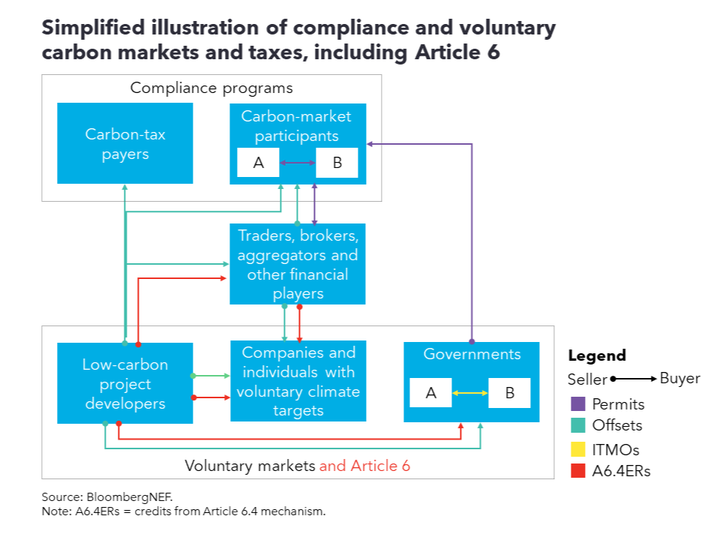

Article 6.4 is one of two global carbon trading mechanisms outlined under Article 6 of the Paris Agreement. When put in place, it will allow both governments and companies to trade emission reduction credits. This international carbon credit trading system will be overseen by a UN-appointed Supervisory Body, which is in charge of developing and supervising the processes required to effectively implement Article 6.4. These include establishing approved methodologies, registering activities, accrediting independent verification bodies, and maintaining the registry.

Before applying to the Supervisory Body for credit issuances, project developers need to seek approval for these credits from the host country. Once completed, the credits could then be transacted with governments, companies and individuals. This is similar to the Kyoto Protocol’s Clean Development Mechanism, except Article 6.4 is expected to achieve an overall reduction in global emissions by preventing double counting. Once an offset is transferred to a buyer, it is canceled to stop the seller from using the same credit for its own compliance.

Effective implementation of Article 6.4 could support countries in achieving their Nationally Determined Contributions – their plans to help meet the goals of the Paris Agreement – and spur greater climate ambition. This is because governments and corporations will be able to tap a pool of certified offsets immediately and efficiently for their decarbonization strategies.

If rolled out successfully, Article 6.4 could also channel much-needed climate financing across borders and from companies in the private sector to national governments, driving the transition toward a low-carbon economy.

Progress thus far

Despite the Supervisory Body having held 13 meetings to date, little progress has been made in relation to finally getting Article 6.4 off the ground. Prior to COP28 towards the end of 2023, stakeholders had hoped to fully roll out the Article 6.4 mechanism at the summit. Unfortunately, the outcome of the conference fell short of expectations as several Parties ultimately rejected the draft, calling for stricter criteria that would safeguard the environmental and social integrity of Article 6.4.

But in a surprising turn of events, the Article 6.4 Supervisory Body published a set of standards in October 2024, outlining eligibility criteria for project methodologies and greenhouse gas removal activities to be included in the Article 6.4 mechanism. This could give discussions some momentum ahead of COP29 in November. The standards have been proposed to the signatories of the Paris Agreement, who have the power to overturn them at upcoming COP meeting. Details concerning the verification process of offsets and corresponding adjustments still need to be outlined for Article 6.4 to become operational.

Looking ahead to COP29

This year’s COP29 summit in Baku, Azerbaijan, is a platform for stakeholders to address the longstanding unresolved issues of Article 6.4. Stakeholders can expect the Supervisory Body to present its updated recommendations on carbon removal activities and methodological rules for baseline-setting and additionality. Discussions related to Article 6.4 could start using the published standards as a base, and work on resolving the trading mechanism itself – a stride forward from the disagreements at COP28.

To enact Article 6.4 effectively, a strong foundational structure needs to be established. To maintain trust among market participants, robust processes for authorization and verification of projects need to be put in place to safeguard the integrity of credits transacted under Article 6.4. Since avoiding the double counting of emission savings is a major challenge for Article 6.4, setting up a central accounting system and regulation could appease concerns that stakeholders have in relation to this.

Interactions with the voluntary carbon market

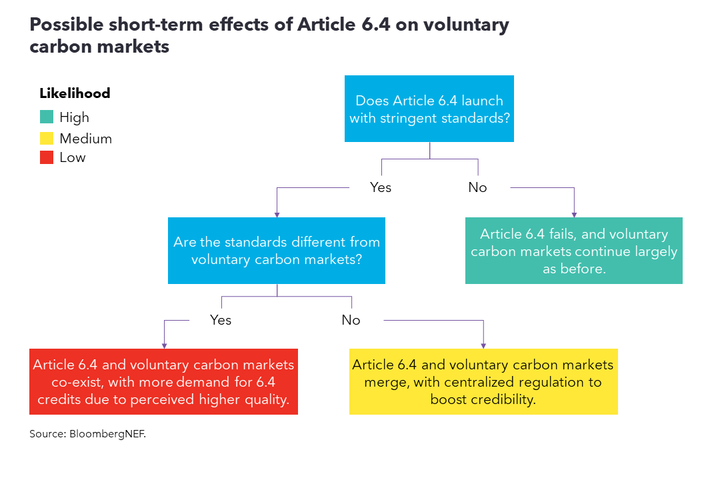

With Article 6.4 coming into the picture, there are some overlaps with the existing voluntary carbon market. The main difference between them right now is the presence of centralized regulation and verification bodies under Article 6.4. Looking ahead, there are three plausible scenarios for the interactions between Article 6.4 and the voluntary carbon market:

-

In the event of a short-lived Article 6.4 due to inefficient trading mechanisms, the voluntary carbon market would likely be unaffected. Unable to turn to the Article 6.4 mechanism to offset their residual emissions, governments and companies would continue to participate in the voluntary carbon market, as they are doing so currently. The likelihood of this scenario occurring is high.

-

Another possible outcome is the coexistence of the voluntary carbon market and Article 6.4 mechanism. This could ultimately introduce reputational and financial risks for buyers because they might face public pressure to procure more expensive Article 6.4-eligible credits, which are viewed as being higher quality, even if they are not required to do so. The likelihood of this occurring is low.

-

If the Supervisory Body adopts existing voluntary carbon market standards for Article 6.4, there could be a merger of both mechanisms. This could increase liquidity in the market, with centralized regulatory oversight from the Supervisory Body. There is a medium likelihood of this happening in the short term.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.