To achieve their increasingly ambitious climate targets, governments are exploring a slew of decarbonization strategies that they could adopt. One avenue is Article 6 of the Paris Agreement, which creates the possibility of international cooperation and emissions trading in the implementation of Nationally Determined Contributions (signatories’ plans to help meet the goals of the Paris treaty). Specifically, many stakeholders are looking to participate in the global carbon trading mechanisms established under Articles 6.2 and 6.4.

Key message

Article 6.2 allows governments to enter bilateral agreements with each other for the trading of ‘internationally transferred mitigation outcomes’. Known as ITMOs, these can be counted toward nations’ climate targets. While there is growing interest and participation in these bilateral deals, an extensive framework needs to be put in place to guide governments’ trading activity and safeguard the quality of ITMOs.

How it works

Through the Article 6.2 mechanism, parties can trade carbon offsets via bilateral agreements to achieve their climate goals. The buyer country purchases ITMOs generated by the seller country. These credits are typically from projects that either reduce or remove emissions. Once transacted, the buyer country can count these ITMOs toward its Nationally Determined Contribution (NDC). Corresponding adjustments, such as deducting the respective credits from the seller country’s inventory when a transfer to the buyer country is authorized, are adopted to prevent double counting of ITMOs.

The introduction of the Article 6.2 mechanism benefits market players with limited emissions abatement potential. These governments could tap other countries’ carbon sink resources to fulfil their climate objectives. Emerging markets are often large suppliers of carbon offset projects so can also reap the rewards of Article 6.2 as the revenue derived from trading ITMOs could be channeled to support their decarbonization efforts.

Progress thus far

At the COP28 climate summit in 2023, parties had hoped to provide specific guidance related to Article 6.2, although ultimately, the discussions in Dubai failed. Market players deliberated over matters such as the authorization of ITMOs, the establishment of an international registry, and the reporting of ITMO transactions. One of the most contentious issues raised was the amount of oversight the UN should have in relation to country-level ITMO transfers. Additionally, stakeholders failed to reach a consensus for other issues, such as the right to revoke credits once they have been transferred.

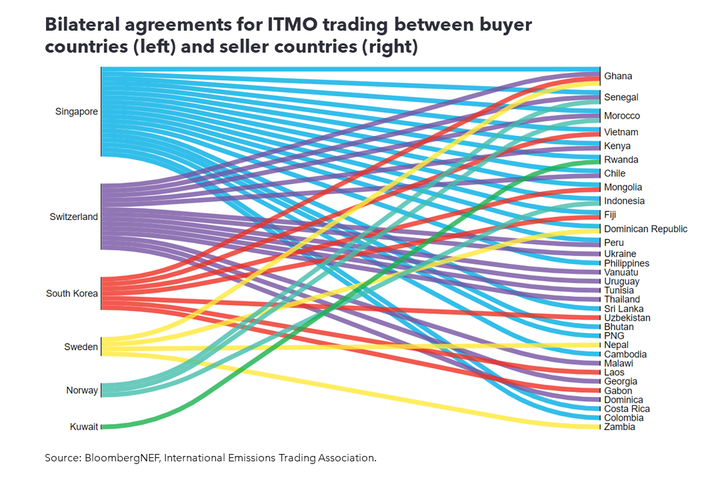

Despite these unresolved topics, governments have continued to forge ahead with bilateral agreements for trading ITMOs. This suggests countries are seeking alternatives to achieve their NDCs while Article 6.4 is still being negotiated. Among the signatories, Singapore and Switzerland have been the most proactive in establishing bilateral deals with other countries, with 19 and 14 agreements, respectively. However, as of May 2024, only one Article 6.2 transaction, between Switzerland and Thailand, had been completed.

What needs to be done

The Article 6.2 mechanism would be instrumental in supporting governments in achieving their NDCs, particularly for countries with limited domestic emissions abatement potential. This underscores the importance of ensuring ITMOs fulfil the criteria of authenticity, verifiability, additionality, and permanence. ‘Additionality’ means the emissions savings would not have occurred without the prospect of the revenue from trading offsets.

However, there is currently no comprehensive framework that sets out the processes to verify these criteria. To appease integrity concerns, stakeholder need to establish an agreed upon structure to screen ITMOs traded.

Stay up to date

Sign up to be alerted when there are new Carbon Knowledge Hub releases.